Now available as a recording, last week’s webinar broke down the current state of the market for US programs.

On October 30, more than 100 US business school professionals joined GMAC Research for the US Application Trends 2019 webinar. Based on the findings detailed in our Application Trends Survey Report 2019, during the 45-minute presentation which we discussed global demand for GME and did a deep dive into the state of the market for US programs. The webinar recording, slides, and transcript are now available to school professionals in the gmac.com Research Library (requires login).

Here’s a quick recap of what we covered:

Global Demand for GME

Total applications to graduate management education (GME) programs declined slightly year-on-year. While total applications were down 3.1 percent year-on-year and more than half of programs report total application declines (52% of programs), GME remains selective and programs continue to seat classes with highly qualified talent.

Though down year-on-year, MBA applications accounted for two-thirds of total GME applications this year, and the MBA remains the predominant credential sought in the industry. Overall, 4 in 5 business school candidates consider an MBA program type (79%), and 2 in 3 consider either a full-time one-year or two-year MBA (65%).

Despite the dip in total applications, business school graduates continue to be in-demand with employers and alumni express high levels of satisfaction. Nearly 9 in 10 employers agree that business school graduates are well prepared to be successful in their company, and the median starting salary for MBA new hires this year was the highest on record (US$115,000). Nine in 10 business school alumni agree that their GME was personally (94%) and professionally (89%) rewarding and would still pursue their degree again knowing what they know now (93%).

International Student Mobility

International student mobility has been among the most discussed themes in the industry over the past couple of years, and the findings of this year’s Application Trends Survey show that ongoing mobility shifts continued to take hold in the market this year.

For one, candidates from the Asia Pacific region are increasingly opting to stay close to home for business school. Data from the mba.com Prospective Students Survey shows that the percentage of Asia-Pacific business school candidates that planned to apply to an Asia-Pacific business school increased from 41 percent in 2017 to 47 percent in the first half of 2019, and as a result this year’s Application Trends Survey shows that 2 in 3 Asia Pacific programs this year report growing or stable domestic application volumes.

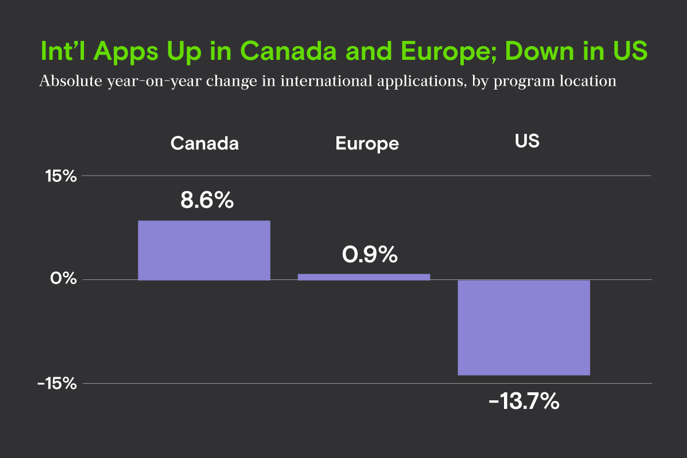

At the same time, the flow of international candidates to Europe and Canada is strengthening. International candidate application plans and preference for these locations are trending up, and this year a majority of programs in Europe and Canada report international application growth. Meanwhile, soft demand from abroad is fueling application declines at US programs. International candidate preference to study in the United States declined from 44 percent to 37 percent between 2017 and the first half of 2019, driven by candidate concerns about work and student visas, the political climate, and discrimination and safety concerns. International applications were down 13.7 percent at US programs that responded to both this year’s and last year’s surveys.

US Deep Dive

Amidst a strong economy, US domestic applications were down slightly this year. Among programs that responded to both this year’s and last year’s surveys, applications from US citizens were down 3.6 percent.

Nearly 3 in 4 US full-time two-year MBA programs report year-on-year declines in total application volume (73%), marking the fourth year in a row of more programs reporting declines than growth. This year, highly ranked US full-time two-year MBA programs saw the steepest declines in applications, as just 6 percent of responding programs ranked in the top 50 of the US News and World Report ranking grew their total application volume this year.

Among professional MBA program types, online options outgrew traditional offerings this year. Even against the current of a strong economy, most US online MBA programs either grew (50%) or maintained (10%) their application volumes year-on-year, and among the 40 percent that report declines, most declined only slightly (23%).

In the diverse and expanding business master’s space, Master of Data Analytics programs continue to be a bright spot, but their growth is slowing amidst growing competition. While a majority of data analytics programs have grown each year for the past five years, the percentage of growing programs has diminished each year, indicating slowing growth. Over the last five testing years, the number of US Master of Data Analytics programs that received GMAT score reports increased by 75 programs, more than any other program type.

Making the Most of Your Participation

To round out the presentation, we reviewed how school professionals can get the most out of their programs’ survey participation by leveraging two data tools made available exclusively to participating programs:

- The data report provides users with the ability to explore and filter the survey data by program type, world region, and program start date

- The benchmark report allows users to compare your program with five or more other programs that responded to the survey

All participating programs received a custom link to these tools via email from research@gmac.com. If you need your program’s link resent, please send us an email.

For more on the Application Trends Survey, visit gmac.com/applicationtrends to access the 2019 report and the infographic series, including the US infographic.